National Best

Universal Life InsuranceUsing the house analogy, Universal Life insurance is like working with an architect and an engineering team to custom-design your dream home. This one offers the most flexibility – with renting, your landlord decides on the paint, flooring, etc.; when you purchase a pre-built house, you can do some work to it, but you must live within certain restrictions (zoning, size of lot, ordinances, etc.).

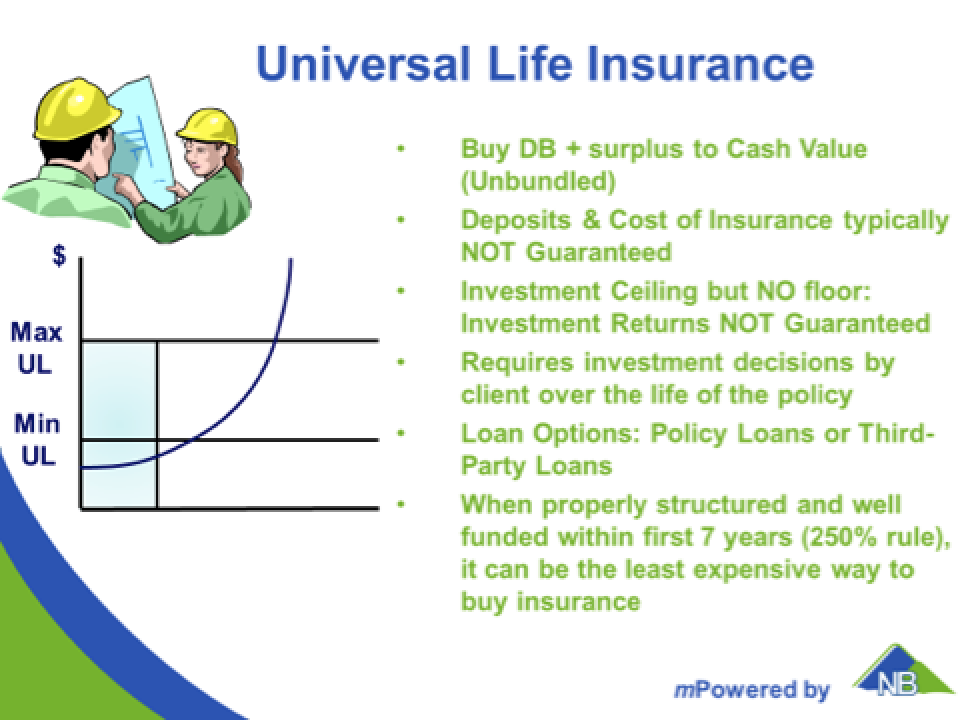

ULs offer the greatest flexibility in terms of how well you fund them since they provide for a variable premium unlike Term and Whole Life which are primarily fixed deposit rates. ULs offer a minimum and maximum deposits so that once it is sufficiently funded, deposits can be halted and then restarted if necessary. Also, the investment choices inside of the policy are chosen by the owner (with help from their advisor), so it requires more oversight and diligence to insure the investment mix is appropriate for the risk tolerance of the client. Because they are an asset, you may be able to use them as collateral for a loan, once again setting up a potential tax-free income.

When building this home, you need to be an active partner in the creation and maintenance of your policy – you wouldn’t hire an architectural firm and tell them, “I want a custom house. Call me when my stuff is moved in.” And you wouldn’t do that here.

Just note that, like other investment products, returns are NOT guaranteed. However, UL policies provide the least expensive way to fund a permanent policy if properly funded early on.

Get In Touch

Head Office:

Unit#: 67B, 4511 Glenmore Trail SE,

Calgary, AB T3C 2R9

Phone: (403) 590-4500

Toll-Free: 1 800 503-6140

Fax: 1 877 904-7715