National Best

Investment ProductsAre you investing for your future with a plan that will work for your risk profile?

As a national broker, we can offer products from a wide range of companies and find the best solution for you as an individual and your individual circumstances. National Best does not represent a specific provider or product. We truly shop the market for clients whether it is investment products, mortgages, or insurance protection, we can build a tailor-made solution for you.

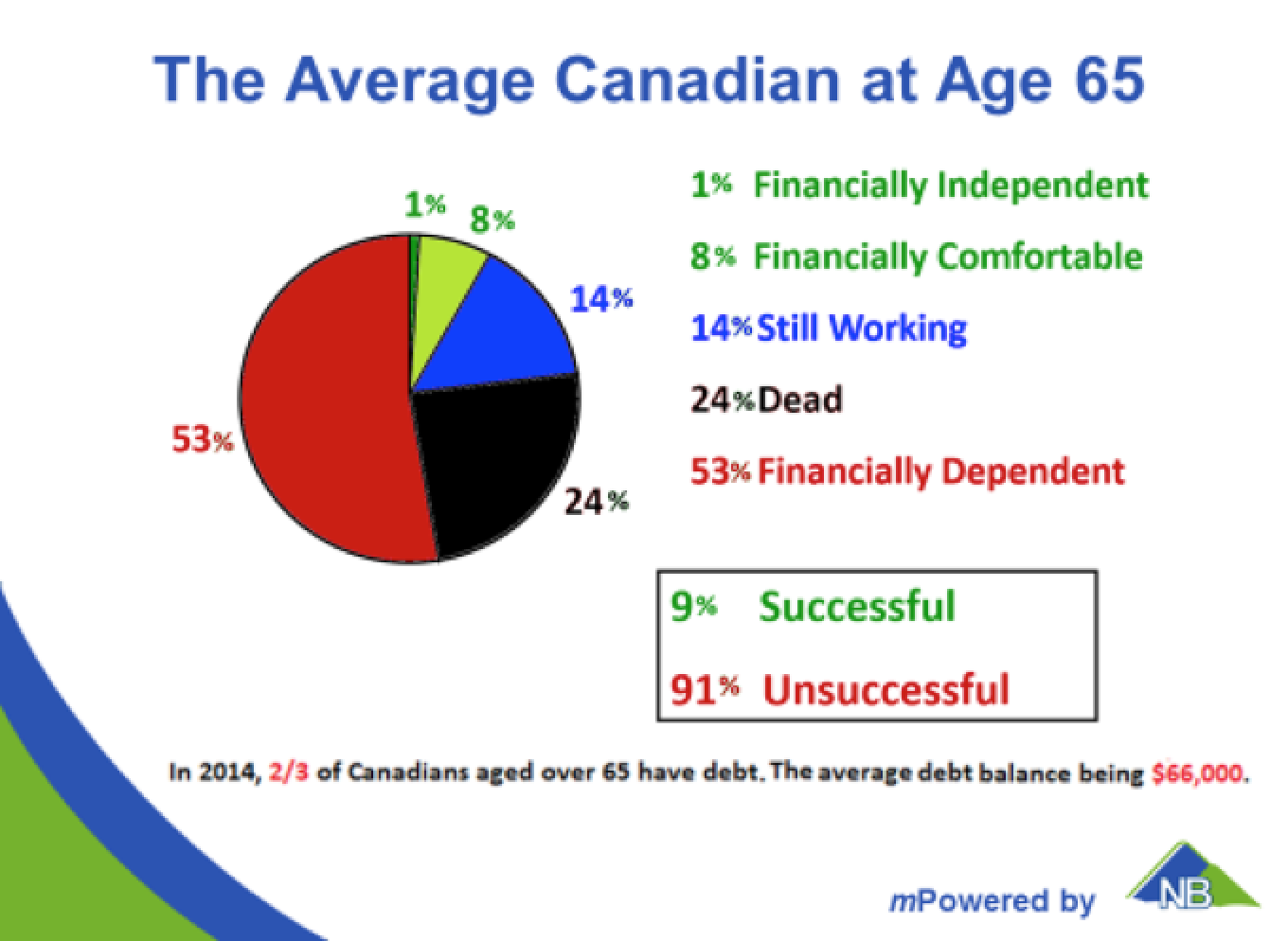

National Best mPowers™ Clients to take control of their financial futures by providing solutions to take control of their debt and improve their cash flow, protect their income and assets, retire with dignity and live their dreams. National Best is proud to offer an array of services and products through our network to our valued clients.

National Best helps their clients fulfill their purpose and passion. Believe in your dreams. We mPower™ you to succeed.

There are broadly six different categories of investment opportunities that a client can choose from. A good investment plan likely combines a number of them to suit your particular situation.

Guaranteed Investment Certificates (GICs) = Guaranteed Investment Accounts (GIAs)

Guaranteed Investment Accounts (GIAs) have all the same benefits as the GIC as the principal and interest payments are guaranteed and offer a similar insurance coverage as the CDIC just through the insurance body known as Assuris.

PLUS ALL THESE BENEFITS that you can only get through your GIA from an insurance company …

Higher Interest Rates: Insurance companies rates are typically higher and more competitive than bank deposit rates.

Beneficiary Designation: A non-registered GIC account cannot have a beneficiary designation, but a non-registered GIA account can. This means the proceeds can go directly to a named beneficiary tax-free.

Estate Planning: At death, the proceeds from a GIC usually incur probate, legal and executor fees, not to mention the time it takes to settle the estate. GIA’s are an insurance product and do not have to pass through the estate. Your beneficiary may be paid directly and quickly, potentially avoiding estate-related fees.

Pension Income Tax Credit: GIC interest income does not qualify for the Pension Income Tax Credit, but interest earned on a GIA does. This means that an investor that is 65 or older may claim the first $2,000 of interest on a non-registered account as eligible pension income.

Creditor Protection: GIC’s, by themselves, cannot offer protection to the owner from his or her creditors. A GIA is an insurance product and, therefore, may provide creditor protection to the policy owner from his or her creditors subject certain conditions.

Annuity

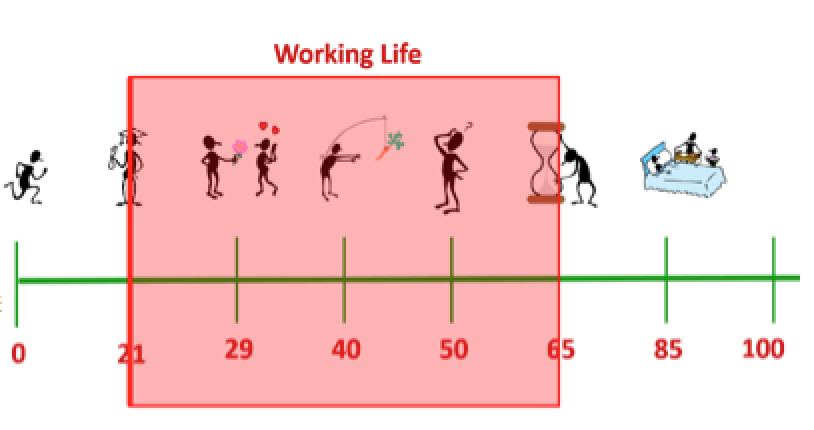

The basic structure of an annuity involves the exchange of a lump of cash for the fixed income stream. A client who has worked his/her whole life and built up substantial savings will look to convert those savings into cash flow to help fund his/her retirement. This is the most common use of an annuity.

Annuities can be very flexible and have many variations but there are two basic structures:

Annuities can be very flexible and have many variations but there are two basic structures:

Life Annuity – ie. Cash flow for life

Term Certain Annuity – A stream of payments for a fixed amount of time. This can be particularly useful for creating cash flow to pay for a regular recurring payment for something over a fixed period.

Mutual Fund

Main Benefits include but are not limited to:

Professional Management • Diversification • Liquidity • Ability to invest a smaller amount

Segregated Fund

Maturity guarantees

Segregated fund policies provide guarantees of either 75% or 100% of the premiums paid (less a proportional amount of redemptions), depending on the product selected. These guarantees allow you to plan more effectively for life events such as your retirement.

Death benefit guarantees

Segregated fund policies provide a principal guarantee in the event of death. This death benefit guarantee is usually either 75% or 100% of the premiums paid (or policy value if you’ve locked in market gains with policy resets) less a proportional amount of redemptions, depending on the product selected.

Named beneficiary

You can choose one or more beneficiaries. These designations can be your estate, your children or other individuals, or associations such as charities.

Potential protection from creditors

Laws may protect a segregated fund policy in the event of bankruptcy or other action by creditors. It’s important to note that creditor protection may depend on court decisions concerning such laws, which can be subject to change and can vary for each province. This protection cannot be guaranteed.

Speedy estate settlement

Segregated fund policies can help speed up estate settlement with protection for you and your family. If you name a beneficiary, the death benefit isn’t subject to the delays and expenses of the probate process.

Lifetime income benefit option

Take control of your retirement and income by guaranteeing your income for life. With the lifetime income benefit option, your income won’t decrease regardless of how the segregated funds perform unless excess withdrawals are taken. You get protection against the risk of outliving your money, market volatility and inflation.

You can choose to receive guaranteed income for life on selected policies—speak to your advisor to learn more.

Guaranteed Minimum Withdrawal Benefits (GMWB) (Also known as a Lifetime Income Benefit Option)

GMWBs are built on a foundation of segregated funds where all or part of your investment is guaranteed after a 15-year period as well as on death. Additional guarantees are added so that you can withdraw a minimum amount of income every year for life, typically 5 percent of your investment starting at age 65. There’s the potential for growth as well as security with a GMWB.

Exempt Market Product Offerings

Why Invest in the Private Market?

The short answer is that research has shown the best investment strategies are ones that promote true diversification. Many are familiar with the success stories of the pension and endowment funds in Canada and the US. Private market products can comprise up to 40% of their total investment portfolio. That’s a large chunk and that is consistent across a number of successful pension funds. Canadian pension plans have among the highest performing investment portfolios in Canada. They diversify into non-market correlated assets by investing in private opportunities. These funds are well on their way to achieving the required rate of return for their beneficiaries.

The exempt market offers investment products that allow financial advisors to provide private investment opportunities to help properly diversify their portfolio like these successful funds do.

Portfolio Managers

Get In Touch

Head Office:

Unit#: 67B, 4511 Glenmore Trail SE,

Calgary, AB T3C 2R9

Phone: (403) 590-4500

Toll-Free: 1 800 503-6140

Fax: 1 877 904-7715